The Government of Ghana and the Ghana Insurers Association (GIA) have reached an agreement on the participation of insurance companies in the Domestic Debt Exchange Programme (DDEP).

Under the agreement, a joint statement by the two parties on Thursday said, insurance companies will participate in the programme on similar terms as the Banks.

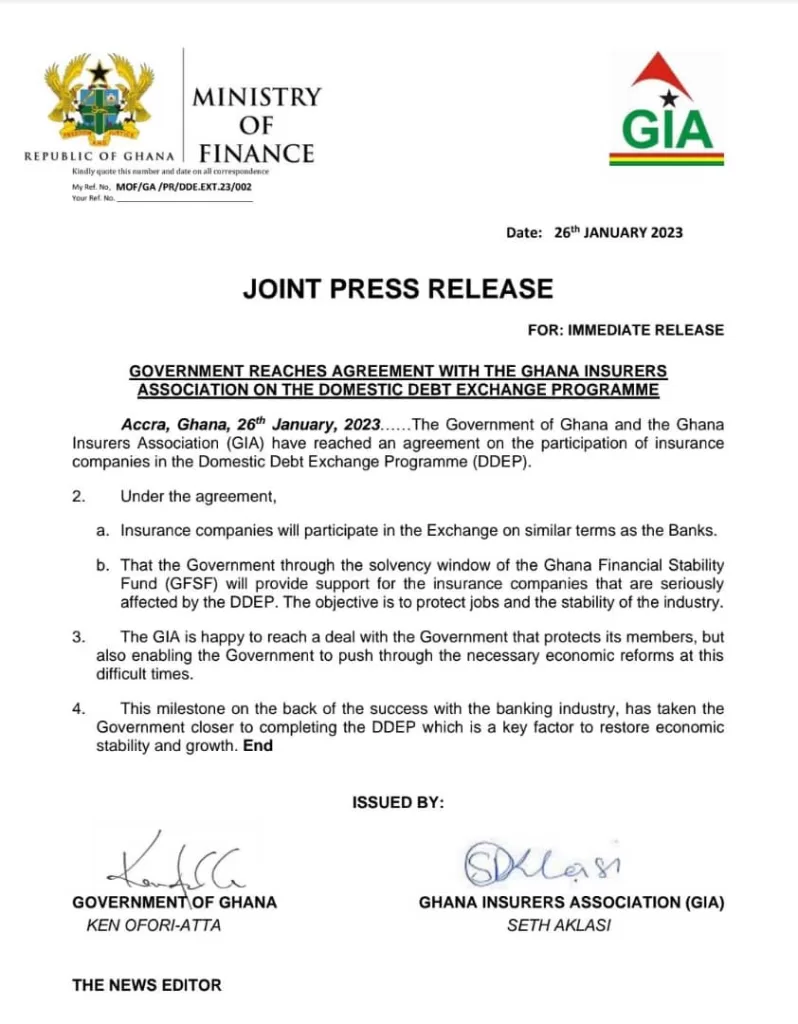

The statement was signed on behalf of the Government of Ghana by the Finance Minister Ken Ofori-Atta, whilst Seth Aklasi signed on behalf of the Ghana Insurers Association.

“That the Government through the solvency window of the Ghana Financial Stability Fund (GFSF), will provide support for the insurance companies that are seriously affected by the DDEP. The objective is to protect jobs and the stability of the industry,” the statement noted.

It further stated, “The GIA is happy to reach a deal with the Government that protects its members, but also enabling the Government to push through the necessary economic reforms at this difficult times.”

According to the statement, “This milestone on the back of the success with the banking industry, has taken the Government closer to completing the DDEP which is a key factor to restore economic stability and growth.”

The agreement government reached with the Ghana Association of Bank earlier this week, which was described as “significant progress”.

It a joint statement confirming the agreement noted: “An agreement to pay 5% coupon for 2023 and a single coupon rate for each of the twelve (12) new bonds, resulting in an effective coupon rate of 9%.

“Clarity on the operational framework and terms of access to the Ghana Financial Stability Fund (GFSF).

“The removal or amendment of all clauses in the Exchange Memorandum that empower the Republic to, at its sole discretion, vary the terms of the Exchange.”

Read also: Government, banks agree on debt exchange terms