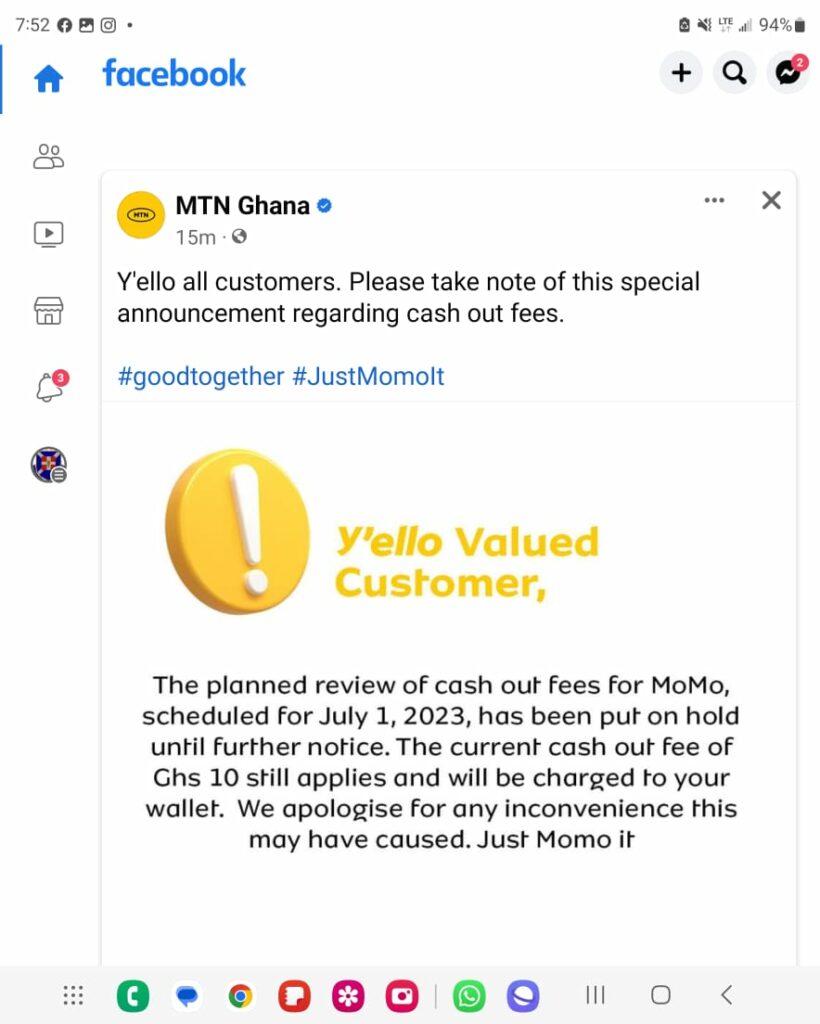

MTN MobileMoney Limited (MML) has suspended the planned increase in mobile money cash transaction fees.

The company announced the suspension in a Facebook post today, Monday, June 26, 2023, which said the planned increment has been put on hold until further notice.

The mobile money market leader had days ago sent out an SMS circular informing customers that beginning July 1, 2023, all cash out transactions of up to GHS2,000 will attract 1% fee, then from GHS2,000 upwards, the fee will remain fixed at GHS20.

Currently, the 1% fee is applied of to amounts up to GHS1,000 and the maximum fee is set as GHS10 for all other amounts beyond GHS1,000.

The planned increase therefore meant that the maximum fee of GHS10, was going to go up by 100%.

MTN itself did not assign reasons for the planned increase, but mobile money agents in the country have come out to explain that they were the brains behind the planned increase.

Executive Secretary of the Mobile Money Agents Association of Ghana (MMAAG), Evans Otumfuo explained that since mobile money started in Ghana 2009 till date, service fees have not been reviewed and as a result the commissions paid to agents have also remained static, in spite of rising inflation and cost of operations.

The agents therefore issued threats of a strike action if MTN does not do something about the situation.

He said, following their complaint, they met with MTN and a consensus was reached the cash out transaction fees will be adjusted upwards to enable the agents make some extra money off their investments so they can sustain their businesses in the fact of stiff competition and ever-increasing high cost of operations.

Indeed, ahead of the planned increase, some mobile money agents have already resorted to the practice of limiting cash out to GHS1,000 maximum at a time. So if a customer wants to cash out more than GHS1,000, it is usually done in batches so the agent can make money off every batch.

MTN has been recording impressive increases in mobile money revenue every year but has not minded to increase the commissions of its agents and merchants, beside organizing some training programs and annual awards events for them.

At the close of last year, MTN reported having 12.7 million mobile money customers. It is expected that as adoption and usage of digital finance increases, service fees will go down across board, to encourage even more usage. It is therefore ironic that in the face of the upward trend in adoption, the market leader has rather chosen to increase a service fee to burden customers.

It is important to take note that the last time MTN suspended a price hike for data bundles until further notice, they eventually went back and implemented the prices increase.

It is however, expected that, in this case, the industry regulator, Bank of Ghana, will intervene and guide the players to find a way around this situation out side of increasing service fees at a time when fees in general are expected to be going down.