Evarline Okello breaks down in tears as she tells me she is hundreds of dollars in debt, after paying a pastor to pray for her.

She lives in a tiny shack in Kibera, a vast slum in the Kenyan capital, Nairobi, and can no longer provide for her four children.

Ms Okello hasn’t earned anything for months, she tells me as we talk on the telephone. So when she heard about a pastor whose prayers could make life better, she wanted to see him. He asked her for $115 (£96; 15,000 Kenyan shillings).

This is known as a “seed offering”: a financial contribution to a religious leader, with a specific outcome in mind.

Ms Okello borrowed the money from a friend, who took out a loan on her behalf. She had been told this pastor’s prayers were so powerful that she would see a return on her money within a week.

But the miracle never came. In fact things got even worse, she says. The loan her friend took out has ballooned due to unpaid interest. She now owes more than $300, and has no idea how she’ll pay it back. Her friend has stopped talking to her, and she still has no job.

“Things have become so difficult I have lost all hope,” she says.

‘Supernatural solutions’

Kenya has been hit hard by the cost-of-living crisis. Food prices rose by almost 16% in the 12 months before September 2022, according to Kenya’s National Bureau of Statistics, while World Bank figures show the number of Kenyans out of work has more than doubled in the past seven years.

“People are living very desperate lives,” says Dr Gladys Nyachieo, a sociologist at Multimedia University of Kenya.

This has increased their desire for supernatural solutions, she says, and many are now willing to pay for a miracle, even if they have to borrow the money.

“People are being told that God doesn’t want them to remain poor. So they plant a seed,” she tells me.

The practice stems from what is known as the Prosperity Gospel, which preaches that God rewards faith with wealth and health. Believers are encouraged to show their faith by giving money, which it is claimed will be repaid by God many times over.

The Prosperity Gospel has its roots in America, where it gained momentum in the early 20th Century. By the late 1970s and early 1980s Nigerian pastors were going to the US to learn more about it, and in the early 2000s its popularity spread across Africa, driven in part by American evangelists such as Reinhard Bonnke, who drew huge crowds from Lagos to Nairobi. That growth in popularity continues today.

Dr Nyachieo also points to another factor tempting people into debt – the offers of loans that regularly pop up on Kenyans’ mobile phones. “People just apply and get the money,” she says.

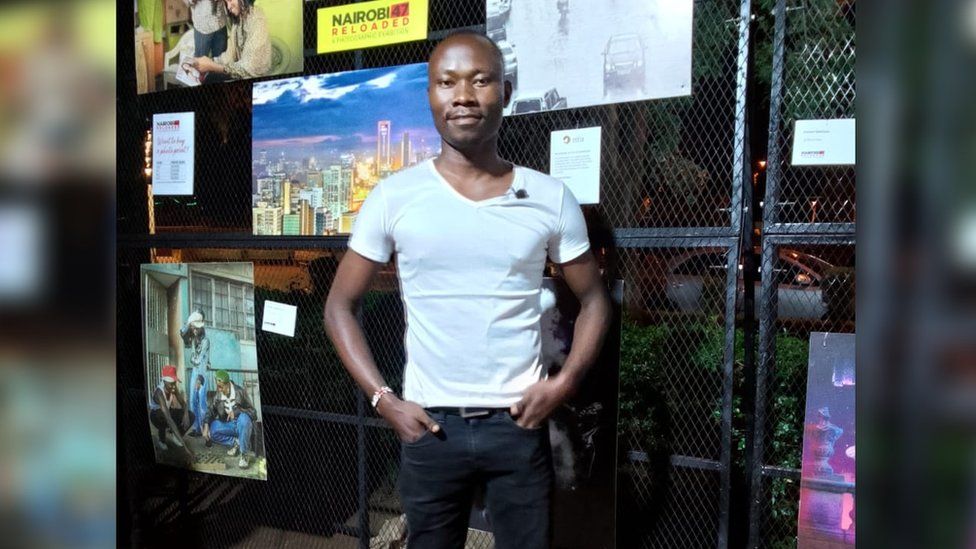

That’s what happened to 26-year-old Dennis Opili. Feeling disheartened after more than three years looking for work, he asked a friend for help.

“He advised me that there is a church where you go and they pray for you. You give a certain offering, then they pray for you, then you can secure a job,” Mr Opili says.

He was told to make a donation every Sunday for three months and gave a total of about $180.

When his savings ran out he borrowed about $120 from cash apps and from friends.

“I believed in what the pastor told me, that I’ll be able to secure a job. So I didn’t have any problems with borrowing, because I thought eventually I’ll be able to pay off the money.”

But when no job appeared, Mr Opili began to suspect that he had been tricked.

Soon he was being pursued by the loan companies for payments.

“Sometimes I’d just be just sitting somewhere, relaxing, thinking about other things. Then somebody calls you, they want you to pay them back their money, and you don’t have anything to pay them with,” he says.

“I was scared because you don’t know what action they could take if you don’t pay them. You don’t know whether they can sue you, or whether they might take you to police custody.”

Luckily he has now managed to find piecemeal work, which has enabled him to pay back part of the money, both to the loan companies and his friends.

“I still very much believe in God,” he says. “All I have to do is just be a little more careful.”

Pressured into giving

It’s not only in Kenya that people are going into debt in the hope of a miracle. A woman who used to attend a Nigerian church in the US says she and her husband came under crippling financial obligations – including the expectation to make seed offerings, or “sow seed”.

“Sarah”, as I will call her, asked me not to use her name, or to say which state in the southern US she lives in, for fear of intimidation from the church or its lawyers.

She says both congregants and local pastors at her former church were expected to give a “tithe” of 10% of their monthly income to finance the church and its leadership in Nigeria. And that was in addition to what was called “first fruit” – their entire pay packet of the first month of the year.

Local leaders were set monthly targets, she says, which forced them to put pressure on the congregation to sow seed. Members were told that they would then be blessed by the head pastor in Nigeria.

Sarah says she saw people paying for “seed money” with their credit cards in church services.

“I remember one time at the church a lady said: ‘I have been paying my tithe, and it seems like I still don’t have enough money at the end of the month.'”

The pastor’s response, Sarah says, was to tell people that giving was more important than paying their rent. And she says anyone who questioned why miracles were not happening was told: “You didn’t pray enough, you didn’t sow seed enough. You didn’t have enough faith.”

She says her husband was pressured to leave her, because she kept asking questions – but they both left the church instead.

Last hope

So why do others stay in such churches?

Dr Jörg Haustein, associate professor of World Christianities at the University of Cambridge, says it is possible to understand why people keep giving when “the promises are not paying off as directly advertised”.

For the middle classes and upwardly mobile, like most of those in Sarah’s church, Dr Haustein says the Prosperity Gospel offers “an air of economic success and upward mobility that people find attractive”.

But it can also appeal to those living in poverty, he says.

“A church that says: ‘We know that you’re suffering, and we have a practical, attainable solution for you,’ will be more attractive than one that preaches some elusive, systemic change.”

But why, I ask, do people continue to give even when it means going into debt?

“Is it not like playing the lottery when you don’t have any money?” Dr Haustein asks me.

“It’s something that seems remotely affordable because you can borrow a few hundred Kenyan shillings on a phone to invest and see if it helps.

“Of course, there is an air of desperation as well, it can be the last best hope one has.”

Back in Kenya, Evarline Okello says the experience hasn’t caused her to abandon her faith.

“I wouldn’t say that church is bad. The church is good. It is the pastors who are doing wrong. They are the ones who are asking for money.”