The Minority in Parliament is calling on President Nana Addo Dankwa Akufo-Addo to suspend the Domestic Debt Exchange (DDE) Programme immediately.

The caucus told journalists in Accra on Monday, January 16 that the policy does not bode well for the economy.

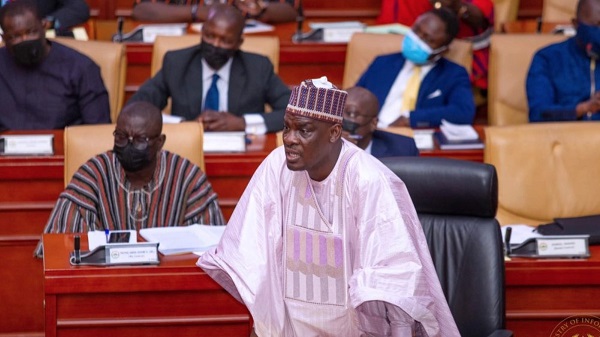

“It is already failing and promises to be a failure,” Minority Leader Haruna Iddrisu said at a press conference.

After an assurance to Organised Labour that pension funds will not be included in the Programme, individual bondholders were given up to Monday, January 16 to subscribe.

This generated a lot of controversy as these bondholders have petitioned not only the Minister of Finance, Ken Ofori-Atta, but some key statesmen to exclude their bonds from the Programme.

Under the Domestic Debt Exchange Programme, domestic bondholders have been asked to exchange their instruments for new ones.

Existing domestic bonds will be exchanged for a set of four new bonds maturing in 2027, 2029, 2032 and 2037.

The annual coupon on all of those bonds will be set at 0% in 2023, 5% in 2024 and 10% from 2025 until maturity with coupon payments done semiannually.

The Tamale South Member of Parliament (MP) said the Programme will only further exacerbate the already perilous financial sector, which was wounded by the 2017 clean-up by the government.

He minced no words by saying the Programme has been poorly-crafted and the earlier it is suspended the better.

“He should suspend the initiative and engage in deeper consultation and allow for greater consultations,” the Minority Leader demanded of President Akufo-Addo.

He said failure of the Programme, which seems to be imminent in his estimation, will mean failure to get an approval from the Executive Board of the International Monetary Fund (IMF) from whom the country is seeking an extended credit facility (ECF) worth $3 billion.