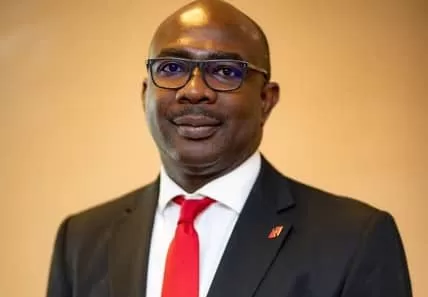

UBA Ghana Ltd has welcomed Uzoechina Molokwu into the role of Deputy Managing Director, effective from August 1, 2023.

His appointment aims to bolster the management team’s capabilities in overseeing operations within the country and driving its growth trajectory.

Drawing from an extensive background spanning more than two decades in the banking sector, Uzoechina Molokwu brings a wealth of expertise to his new role at UBA Ghana.

His previous engagements at UBA Nigeria, including positions as Directorate Head, Regional Manager, and Branch Manager, culminating in his tenure as Executive Director at UBA Cote D’Ivoire, have endowed him with valuable market experience.

Uzoechina’s professional journey encompasses various domains such as corporate banking, Private Client Services, Commercial Banking, Small and Medium Enterprises Banking, Consumer Banking, and Energy Banking.

Moreover, he boasts a commendable track record in relationship management, business development, credit evaluation, restructuring, risk asset portfolio management, and effective people leadership.

In response to the appointment, Chris Ofikulu, Managing Director at UBA Ghana and UBA West Africa Regional CEO, expressed enthusiasm, stating, “We are thrilled to have an individual of his calibre and experience contributing to our Ghana operations. We are confident that he will significantly enhance our pursuit of visionary goals while introducing innovative banking solutions.”

UBA Ghana extends its congratulations to Uzoechina Molokwu on his new role as Deputy Managing Director and extends well wishes for a productive and successful tenure.

Uzoechina holds a BA in Philosophy and an MBA from Nigerian Universities, along with an MSc in Corporate Governance and an LLM in Business Law, both earned from UK Universities.

UBA is a leading Pan-African financial institution, and a foremost player in the financial sector in Africa with a workforce of 25,000 employees, serving over 35 million customers globally

The bank also operates in the United Kingdom, the United States, France, and the United Arab Emirates, providing a broad range of retail, commercial, and institutional banking services, spearheading financial inclusion and employing cutting-edge technology.

The Bank started operation in Ghana in 2005 and has 31 fully networked branches and a leader in Trade finance, cross boarder payments, remittance and ancillary banking services