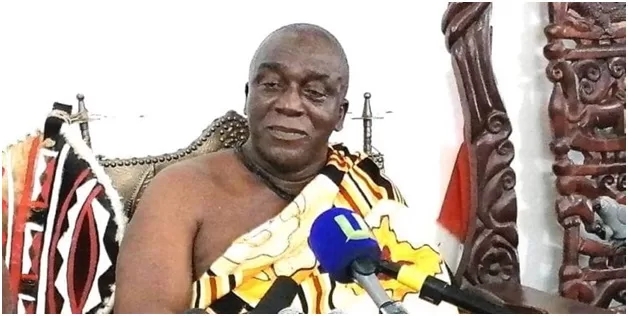

The Paramount Chief of Essikado Traditional Area in the Western Region, Nana Kobina Nketsia V, says the public must know the full voting records of their Members of Parliament, especially on the approval of loan agreements.

The traditional ruler cum academician was speaking at a public forum as part of events to mark 30 years of parliamentary democracy in Takoradi.

According to the Omanhene [Paramount Chief], Parliament cannot continue to approve all loan agreements put before it and refuse to accept part of the responsibility for the country’s current debt crisis.

He cited former Sekondi MP, Paapa Owusu Ankomah and the MP for Essikado-Ketan, Joe Ghartey who reside in his traditional jurisdiction.

He said he would like to demand their voting records and the reasons behind their votes in support of loan agreements that have led the country to the current economic doldrums.

“Sometimes I even ask myself, should they sit in parliament based on party lines?. One is Paapa Owusu Ankomah and the other one is Joe Ghartey. We are in debt. I would like to see their voting records.”

“How many of those loans did they vote for and why did they vote for it. Has anyone told us and what is Parliament doing about it?”

“We are in debt and anytime they bring the loans, MPs vote and accept it as if we are mad people in this country,” he said angrily.

Audio PlayerMeanwhile, the October 2022 Bank of Ghana Summary of Economic and Financial Data has revealed that Ghana’s public debt stock went up by ¢9 billion in July 2022 to ¢402.4 billion.

This is equivalent to 68% of Gross Domestic Product, and is in sharp contrast to the projected 104.6% of debt to GDP ratio in 2022 by the World Bank.

In dollar terms, the country’s debt dropped marginally to $53.2 billion in July 2022, from $54.4 billion in June 2022.

Based on the data, the nation did not borrow fresh funds from the international market during the period. However, the debt level will go up going forward, following the $750 million Afrieximbank loan that came in August 2022.

According to the data, the external debt remained largely unchanged at $28 billion, equivalent to 35.8% of GDP.

The domestic debt however has been going up since January 2022 because of the significant borrowing by the government in the domestic financial market.

It stood at ¢190.3 billion in July 2022, from ¢190.1 billion in June 2022.