A British mining firm operating the Bogoso Prestea Mine in Ghana, the Blue Gold Holdings Limited has issued an ultimatum to the Government of Ghana, demanding a resolution to the ongoing dispute concerning the Bogoso Prestea Bogoso Mine by January 14, 2025.

Should the government fail to comply, the investors have threatened to initiate international arbitration proceedings under Article 10 of the UK-Ghana Bilateral Investment Treaty (BIT), which could affect Ghana’s chance of securing loans and other support from the World Bank.

The dispute stems from the Ghanaian government’s decision to approve the sale of the mine to Heath Goldfields Ltd., a move the investors allege violates their protected investments.

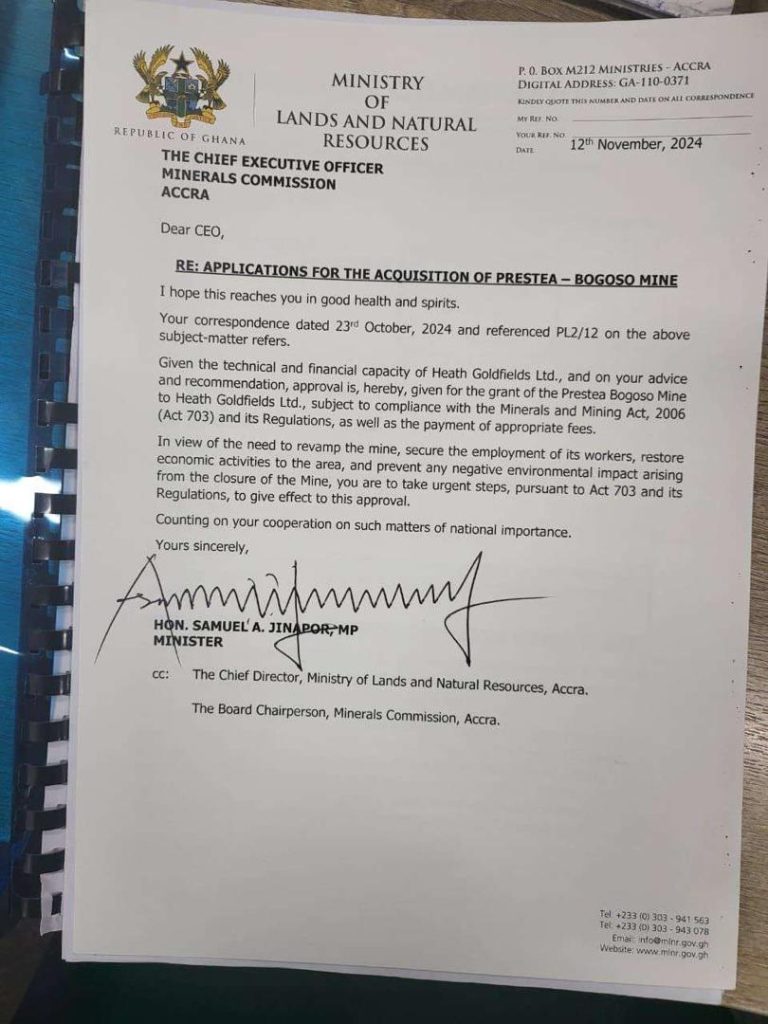

A letter dated November 12, 2024, from the Minister of Lands and Natural Resources, Samuel Abu Jinapor, to the Chief Executive Officer of the Minerals Commission, granted approval for this transfer. The letter highlighted Heath Goldfields Ltd.’s technical and financial capacity while emphasizing the need to revamp the mine, secure employment for workers, and restore economic activities in the region.

Allegations of Unlawful Actions

But in a letter dated November 13, 2024, from the legal representatives of Future Global Resources Limited (FGRL) and Blue Gold Holdings Limited (BGHL), Mayer Brown International LLP, to Ghana’s Attorney General, the investors accused the government of facilitating the illegal transfer of their assets and failing to protect their investments.

They claimed that unauthorized parties, allegedly aligned with the Minerals Commission, were extracting and selling gold tailings worth millions of dollars from the mine. This, the investors argue, breaches the UK-Ghana BIT’s provisions on fair treatment and protection of foreign investments.

Additionally, the investors accused the government of breaching multiple BIT articles, including Article 3(1), which mandates fair and equitable treatment, and Article 7, which prohibits expropriation without adequate compensation.

The investors’ notice highlighted that unresolved disputes of this nature could harm Ghana’s international credit standing, particularly with the World Bank.

The World Bank’s operating guidelines caution against lending to countries that fail to reasonably settle disputes over expropriation, emphasizing the potential long-term financial implications for Ghana.

Call for Amicable Settlement

FGRL and BGHL have reiterated their willingness to engage in amicable settlement discussions with relevant Ghanaian authorities. They propose such discussions occur in Accra or London at a mutually agreeable date.

“In the interest of avoiding a protracted dispute, the Investors invited Ghana to engage in urgent amicable settlement discussions. Pending the initiation of such discussions, the Investors urged Ghana to take action to address their serious concerns over the continued illegal occupation of the Mine and, in particular, to refrain from taking any further actions to aggravate the dispute,” the lawyers’ letter to the Attorney General, Godfred Dame, stated.

However, failure to resolve the matter by the January deadline could lead to significant arbitration claims, potentially exposing Ghana to substantial financial liabilities.

“Should this dispute not be resolved by 14 January 2025, the Investors shall exercise their right to initiate international arbitration proceedings pursuant to Article 10 of the UK-Ghana BIT,” the letter said.

The disputes over expropriation states in part: “The Bank recognizes that a member country may expropriate property of aliens in accordance with applicable legal procedures, in pursuance in good faith of a public purpose, without discrimination on the basis of nationality, and against payment of appropriate compensation. When there are disputes over expropriations that, in the opinion of the Bank, the member country is not making reasonable efforts to settle and that are substantially harming the country’s international credit standing, the Bank considers whether to continue making new loans to or with the guarantee of the member country. Further, the Bank may decide not to appraise proposed projects/programs in such a country unless it has good grounds for believing that the obstacles to lending will soon be removed.”

Source: Newstitbits.com