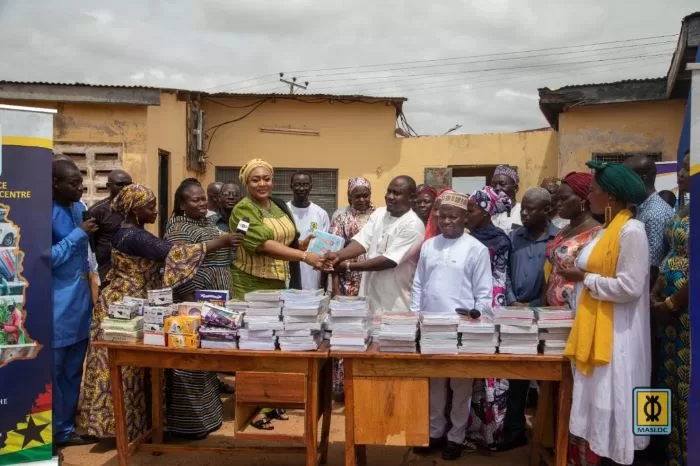

Regina Kumi[/caption]

The Micro Credit Association Ghana (MCAG) with a nationwide membership of about 800 has asked government to allocate a portion of the Microfinance and Small Loans Center (MASLOC) funds to the association to enable members provide loans at affordable rate to individuals and businesses.

In an interview with the board chairperson of MCAG, Regina Kumi on the sideline of the Association’s 9th Annual General Meeting held in Takoradi on 6th September, she noted that MASLOC tends to mimic the functions of micro credit operators, which according to her, it is inappropriate.

“MASLOC operates like micro credit which means they are in competition with us and it does not sound too good,” she stated.

Mrs. Kumi believes MASLOC is influenced politically and government in power is likely to favor its members more, hence the need to re-consider its functions.

She noted the Association is a neutral entity without any political affiliation hence loaning the funds to individuals and businesses will be without discrimination.

“Government should give us the money if not the politicians will be giving out the money to their members at the expense of others who may be in dire needs. We deal with all economically deprived people and we need such affordable funds to lend it out to people at low interest rate.”

[caption id="attachment_97367" align="aligncenter" width="634"] Kweku Kwarteng[/caption]

In response, the Deputy Minister of Finance, Kweku Kwarteng who was the special guest acknowledged the concern but noted that stakeholders will need to think through to ascertain how viable the request is, before government can take a decision.

“It is a laudable concern that government can consider what the association calls it wholesale lending and they will do retail lending to beneficiaries.”

The deputy minister was quick to add that MASLOC is being guided by regulations and expected the Association as well as all to comply with.

MASLOC currently provides, manages and regulates on fiduciary basis, approved funds for microfinance and small scale credit schemes and programs and also serve as the apex entity of the microfinance sub sector. It also promotes and enhances the development of a decentralized micro financial system.

By Loveridge Ampratwum Okyere/ Connect FM/3news.com /Ghana]]>

Kweku Kwarteng[/caption]

In response, the Deputy Minister of Finance, Kweku Kwarteng who was the special guest acknowledged the concern but noted that stakeholders will need to think through to ascertain how viable the request is, before government can take a decision.

“It is a laudable concern that government can consider what the association calls it wholesale lending and they will do retail lending to beneficiaries.”

The deputy minister was quick to add that MASLOC is being guided by regulations and expected the Association as well as all to comply with.

MASLOC currently provides, manages and regulates on fiduciary basis, approved funds for microfinance and small scale credit schemes and programs and also serve as the apex entity of the microfinance sub sector. It also promotes and enhances the development of a decentralized micro financial system.

By Loveridge Ampratwum Okyere/ Connect FM/3news.com /Ghana]]>

MASLOC is competing with us – Micro Credit Association cries foul

Reading Time: 3 mins read

Recent Posts

- Ghanaian sports journalist Naa Shika Stargurl shines on global stage

- Central Regional Minister to go to Court over her dismissal from NPP?

- NPP accuses NDC of lawlessness, demands urgent re-collation by EC in disputed constituencies

- Anytime there’s vigilance, NDC wins – Malik Basintale

- Akufo-Addo statue in Takoradi suffers partial damage amid controversy

- Current financial year proving challenging for COCOBOD – IMF

- Agona West NPP expels Regional Minister, 282 others for anti-party activities

- Cholera outbreak in Western region claims 14 lives, over 800 cases recorded

Popular Stories

-

Agona West NPP expels Regional Minister, 282 others for anti-party activities

-

Central Regional Minister to go to Court over her dismissal from NPP?

-

Akufo-Addo statue in Takoradi suffers partial damage amid controversy

-

Ghanaian sports journalist Naa Shika Stargurl shines on global stage

-

Current financial year proving challenging for COCOBOD – IMF

ABOUT US

Newstitbits.com is a 21st Century journalism providing the needed independent, credible, fair and reliable alternative in comprehensive news delivering that promotes knowledge, political stability and economic prosperity.

Contact us: [email protected]

@2023 – Newstitbits.com. All Rights Reserved.